News

Detailed Explanation of EU Regulation (EU) 2025/40 on Packaging and Packaging Waste for Building Materials

Date:

2025-5-29

The EU Green Packaging Regulation: Starting from 2025, the EU will set limits on the recycled material content in imported building material packaging bags (currently requiring ≥30%), which will push companies to accelerate the development of environmentally friendly mortar bags.

The EU Regulation (EU) 2025/40 on Packaging and Packaging Waste has officially come into effect on February 11, 2025. This new regulation replaces the Packaging and Packaging Waste Directive (94/62/EC), establishing rules for the entire life cycle of packaging to promote the effective functioning of the internal market while reducing the negative impact of packaging and packaging waste on the environment and human health, and driving the transition to a circular economy.

Detailed Explanation of the Regulation

1. Recycled Material Content Standard

Minimum 30% Recycled Material: This is the current baseline requirement, which may be increased in stages to 50% after 2025 (as proposed by Germany).

Traceability Proof: Importers must provide third-party certification (such as the EU Ecolabel, EPD declaration) or supply chain audit reports to prove traceability.

2. Exemptions and Transition Provisions

Exemptions: Packaging for mortar additives in contact with food may be exempted (subject to compliance with EC 1935/2004 regulations).

Transition Period for SMES: Small and medium-sized enterprises (SMES) can apply for a 2-year transition period, but they must submit alternative plans.

3.Direct Impact on the Mortar Bag Industry

3.1. Increased Supply Chain Costs

Price Fluctuations of Recycled PP/PE: The price of European recycled plastics (rPP/rPE) is 15-30% higher than that of virgin resins, and supply is tight (dependent on imported recycled granules).

Increased Certification Costs: The cost of a life cycle assessment (LCA) for a single packaging model is approximately €5,000-10,000, placing significant pressure on SMEs.

3.2. Higher Technical Barriers

Performance Balance Challenge: Adding recycled material may reduce tensile strength (e.g., a 10-15% loss in strength for rPP woven bags), which needs to be compensated for by adjusting the weaving density.

Moisture Barrier Restrictions: Traditional aluminum-plastic composite films are difficult to recycle, prompting the development of recyclable high-barrier coatings (such as SiO:coatings).

3.3. Reshaping of Market Landscape

3.3.1.Advantages for European Companies: For example, Germany's GCR Group has achieved mass production of 100% recycled PE mortar bags. France's Sacrofan produces "closed-loop certified" rPP through chemical recycling technology.

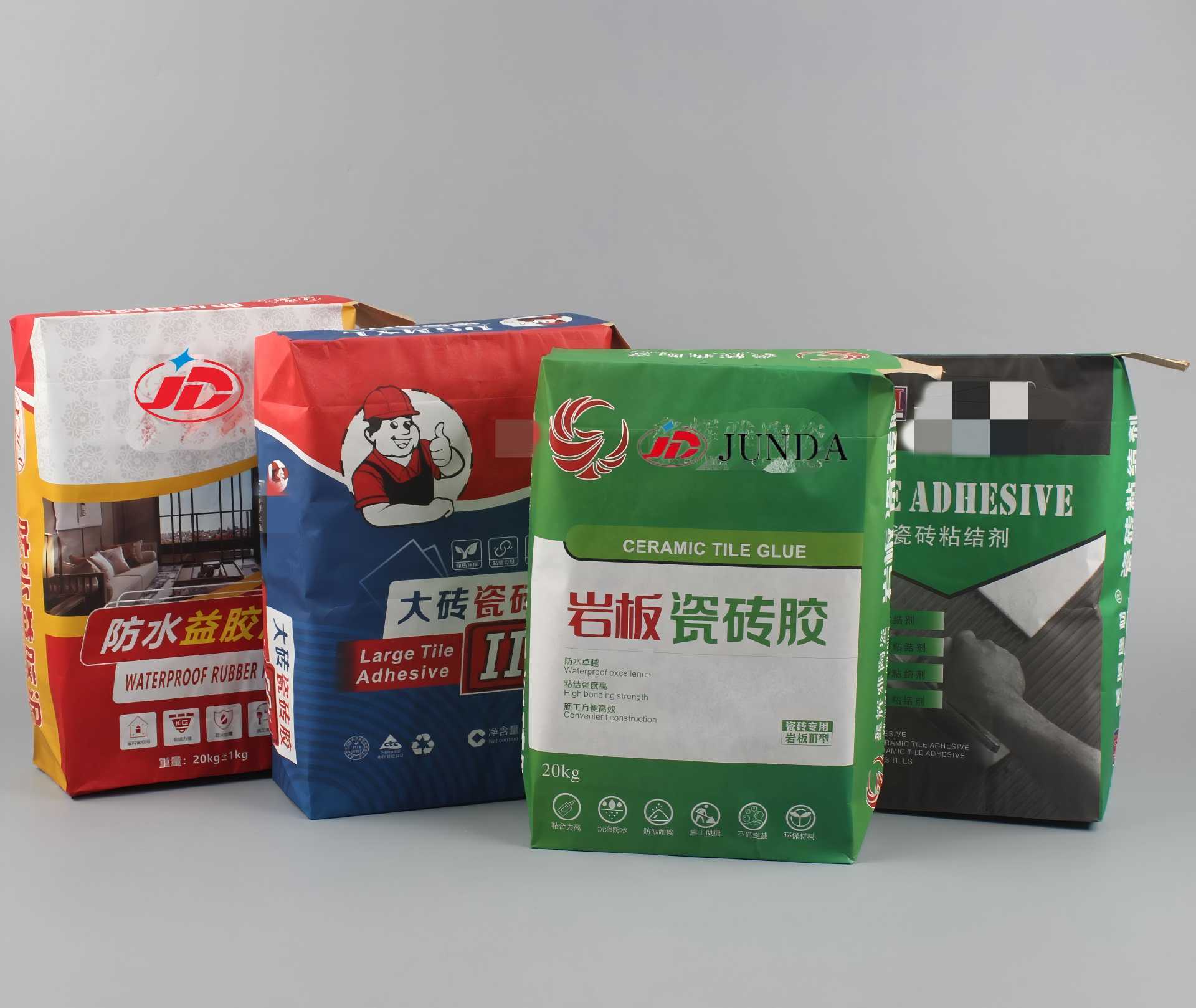

3.3.2.Challenges for Asian Exporters::Chinese Leading Companies: Companies like Anhui Jitai New Materials in China are accelerating the layout of rPP production lines, but most small and medium-sized factories still rely on virgin materials.

3.3.3.Southeast Asian Manufacturers: They may shift to markets with lower regulatory requirements, such as the Middle East and Africa.

4.Corporate Response Strategies

4.1. Material Innovation

Example: Italy's BillerudKorsnäs has launched a "kraft paper + recycled PE lining" bag with a recycled material content of 40%, which is fully recyclable. BASF has developed the "IrgaCycle" additive to enhance the weather resistance of recycled PP (suitable for outdoor mortar storage).

4.2. Business Model Adjustment

Lease Service: The Netherlands' Vanheede company provides reusable mortar bags (with a single bag usable ≥8 times), reducing the demand for single-use packaging.

Deposit System: Austrian building materials company Wienerberger offers a €5 refund per empty bag returned.

Regional Production: Turkey's Kordsa company has built a factory in Poland to produce mortar bags using local European recycled materials, avoiding import restrictions.

5.Industry Data and Trend Forecast

5.1. Cost Pass-Through of Compliance

Price Increase: The unit price of mortar bags that meet EU standards is expected to rise by 20-35%, but brand companies (such as Saint-Gobain) can offset this through green premiums.

5.2. Technical Substitution Rate

Market Penetration: The penetration rate of recycled material mortar bags in the European market was about 25% in 2024, and it is expected to exceed 50% after 2025.

5.3. Potential Risks

Greenwashing Review: Developing countries' exports of recycled materials may face "greenwashing" reviews, necessitating the strengthening of traceability systems (such as blockchain applications).

6.Recommendations for Chinese Companies

6.1. Early Layout of Recycled Material Capacity

Cooperation with European Recyclers: Partner with European recyclers (such as Veolia) to secure rPP supply, or invest in domestic chemical recycling technology (such as Zhejiang JiaRen New Materials).

6.2. Obtain International Certifications

Certifications: Obtain ISCC PLUS (International Sustainability and Carbon Certification) or EuCertPlast (European Recycled Plastics Certification).

6.3. Functional Alternative Solutions

Non-Plastic Paper-Based Bags: Develop non-plastic paper-based bags (such as the moisture-proof paper bags from Hunan Yutong Technology) to bypass the plastic recycling requirements.